The Rarest and Most Unique Geeky Gifts of Holiday Season 2024

Looking for extra special geeky gifts for the loved ones who prefer the rarest of collectibles? We've got you covered!

This article is part of the Collector’s Digest Holiday Edition powered by:

The thing about being a fan is that, like going on a quest in a fantasy realm, searching for things that you love is part of the fun. Hobbits have to walk a long way to complete their tasks. Luke Skywalker has to find a ship to get him off Tatooine. You get it. Treasure, literal and figurative is foten involved in all the things we love the most. And, around the time of the holidays, you might be wondering what geeky treasures are the best, and also the most elusive.

Diving into eBay is a great way to find pop culture treasures from the distant past as well as the hottest things right now. And, when it comes to finding a great gift, it’s not just that some thing that is really geeky, but also something that is unique. With that in mind, here are a bunch of rare, unique geeky gifts, perfect for yourself, or someone in your life who has to have the thing that nobody every thought to get.

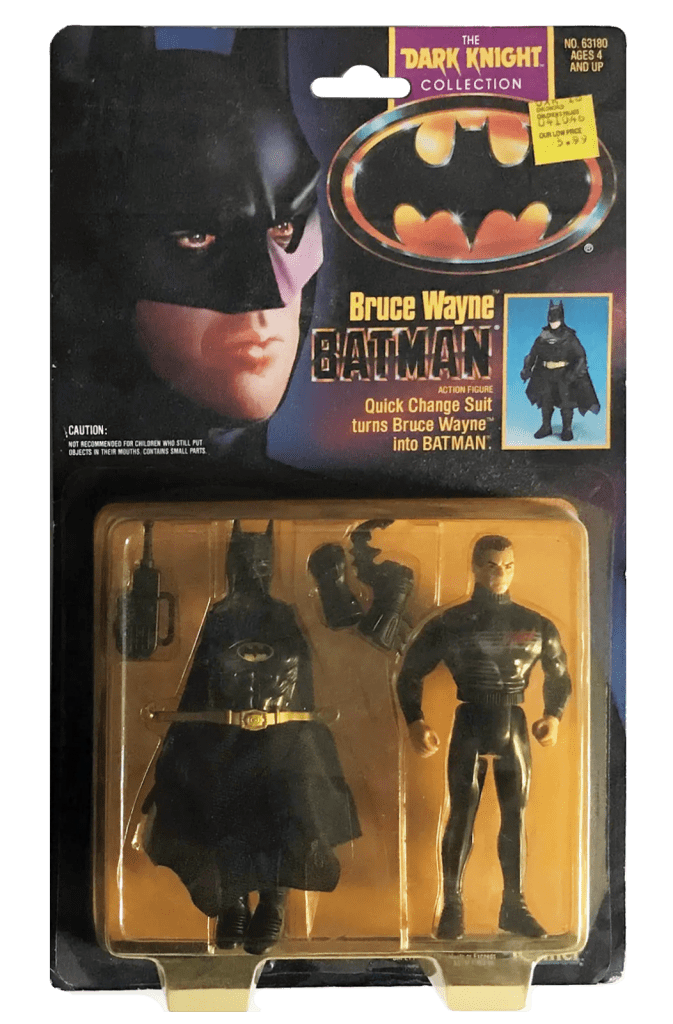

1990 Bruce Wayne Quick Change Action Figure (Kenner)

One of the greatest things about ‘80s and ‘90s action figures was the endless supply of characters rocking outfits they never wore in their respective movies or TV shows. Sometimes it felt like it was easier to find “Ice Attack Batman” than, say, a regular Batman. However, the Quick Change Bruce Wayne action figure split the difference.

With this action figure, Bruce Wayne (Michael Keaton) is wearing a ridiculous turtleneck, complete with a requisite ‘80s/’90s red little squiggle line. But, because he comes with this Batman suit, you can pop him into that with relative ease.

Buy the Bruce Wayne Action Figure Here

1998 Dark Empire Princess Leia Jedi Action Figure (Kenner)

Kids in the late 1990s were so confused about Star Wars. Many of the Star Wars toys of the time were almost exclusively focused on events that didn’t take place in the original trilogy, but instead, focused on characters and specifics from the comics and novels. In 1996, this hit a fever pitch with the various Shadows of the Empire toys, but less discussed are the excellent toys Kenner produced based on the Dark Empire comics from 1991. In 1998, you could get a dark side version of Luke Skywalker, a young cloned Emperor Palpatine, and coolest of all, Princess Leia as a full-blown Jedi.

Refreshingly, this comes from a time when Lucasfilm wasn’t too fussy about lightsaber color, meaning Leia’s orange/red saber here doesn’t mean anything other than the fact that she’s a badass.

Buy the Leia Jedi Action Figure Here

2023 Magic: The Gathering Secret Lair, Lord of the Rings Foil Cards (Wizards of the Coast)

Okay, so you probably know that Wizards of the Coast has turned pretty much every IP known to humankind into playable Magic cards at this point. But, in 2023, you might have missed the fact that as a part of The Lord of the Rings cards for Magic: The Gathering, there were some limited edition “Secret Lair” cards with art taken directly from the most obscure and weirdest version of LotR ever. These cards sported art from the 1978 Ralph Bakshi version of Lord of the Rings.

The coolest of these is arguably the foil of the version of Mirror of Galadriel, which sports a vintage screen pull directly from 1978, featuring the animated version of Galadriel, who was, in that film, voiced by Annette Crosbie.

Buy MTG Lord of the Rings Cards Here

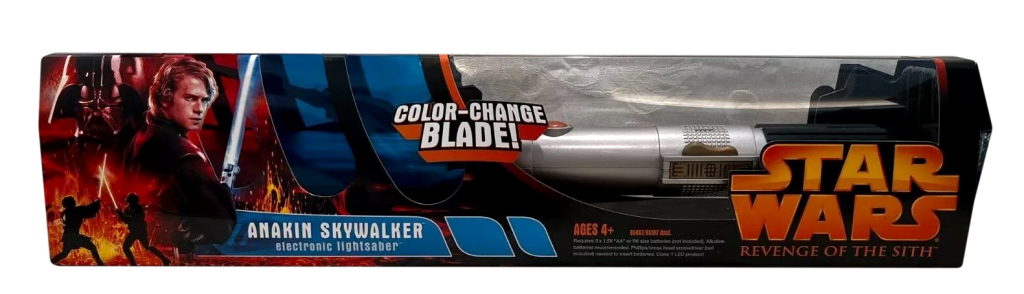

1999 Phantom Menace Qui-Gon Jinn Lightsaber (Hasbro)

There have been various improvements to lightsaber toys since the 1970s, and there are plenty of contemporary lightsaber toys but, it’s very possible that twenty-five years ago, in 1999, the best lightsaber toy ever was released. Mind you, not the most efficient or most accurate replica, but simply the best toy lightsaber.

The Qui-Gon Jinn green-bladed lightsaber from 1999 was longer than many of the ones that were released after, and had a nice dark green blade rather than the nearly transparent ones that were created later. Yes, the red button was in the worst spot for doing that lightsaber-spinning thing, but you can get used to it.

Buy the Qui-Gon Jinn Lightsaber Here

2009 Star Trek Reboot Phaser Toy (Playmates)

It’s strange to have nostalgia for 2009, specifically, the first J.J. Abrams Star Trek reboot, but here we are. It’s been 15 years since Chris Pine and the gang boldly reimagined the classic Enterprise crew. And, as such, some of the stuff from that era is suddenly feeling a bit vintage. Specifically, the redesigned phaser that Kirk and Spock rocked while taking down Nero’s Romulan ship in the climax of that now (somehow?) classic film.

This phaser design has a feature where the blue setting indicates “stun” and the red setting indicates well, you can guess what the opposite of “stun” is. Aspects of this design were incorporated into the Discovery phasers in 2017, so there’s a lot of weird Star Trek canon crossing over with itself in this slightly hard-to-find elegant Starfleet weapon.

Buy the Star Trek Reboot Phaser Here

2022 Lower Decks USS Titan (Eaglemoss)

When Eaglemoss went bankrupt in 2022, the popular replica maker was very close to releasing starship models for every single Star Trek incarnation up until that point. And one of the last ships that Eaglemoss made was the Lower Decks version of the USS Titan. Not to be confused with the Titan from Star Trek: Picard Season 3, this is the Titan from Lower Decks Season 1 and Season 2, which is the moment where Riker is very much in command of the ship.

This Luna-class USS Titan is pretty slick, and the Eaglemoss version of this ship specifically from Lower Decks is among the harder-to-find Star Trek starship replicas. If there’s a white whale of contemporary Star Trek models, it’s this.

Buy the Lower Decks USS Titan Here

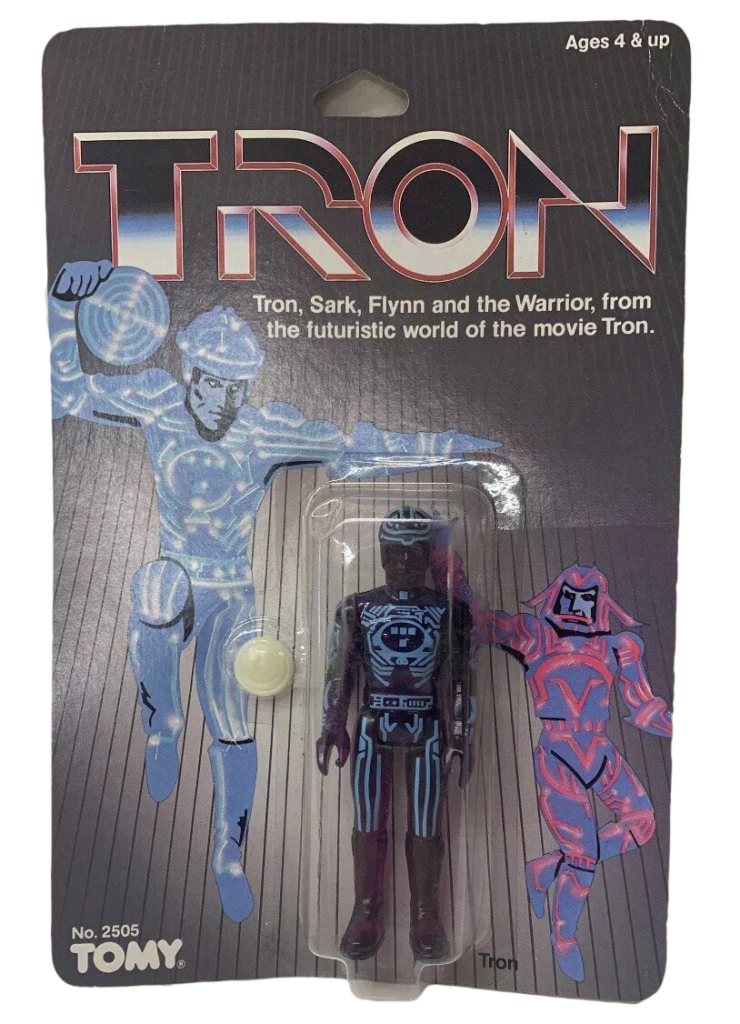

1982 Tron Action Figures

Tron is the most underrated cyberpunk movie of all time, and the precursor to The Matrix and so much more. Thinking about where the world would be without Tron is a frightening thought. That said, collecting original, legit vintage Tron stuff is very difficult. Even the makers of the original toyline, Tomy, seemed to misunderstand the premise of the film, referring to it as a “futuristic world.”

The fact that Tron took place in the present has always been, sneakily, the most compelling thing about it. Right now, vintage Tron figures from 1981 feel like they’re from another world, mostly because many of them are extremely valuable. But if you need a gift that’s a bit off the grid, these are the programs you’re looking for.

Doctor Strange Magic: The Gathering Promo Card

Magic: The Gathering’s eagerly anticipated crossover with Marvel doesn’t come out until 2025, but fans lucky enough to attend the MTG panel at New York Comic Con 2024 got an early sample. Everyone in attendance was given a limited edition Doctor Strange Counterspell promo card. Suffice to say, Marvel’s premiere sorcerer casting one of Magic’s most iconic spells is pretty dang cool. This would be quite the neat gift, especially considering how hard it was to get the other early cards from the Secret Lair Marvel Superdrop.

Buy the MTG Doctor Strange Card Here

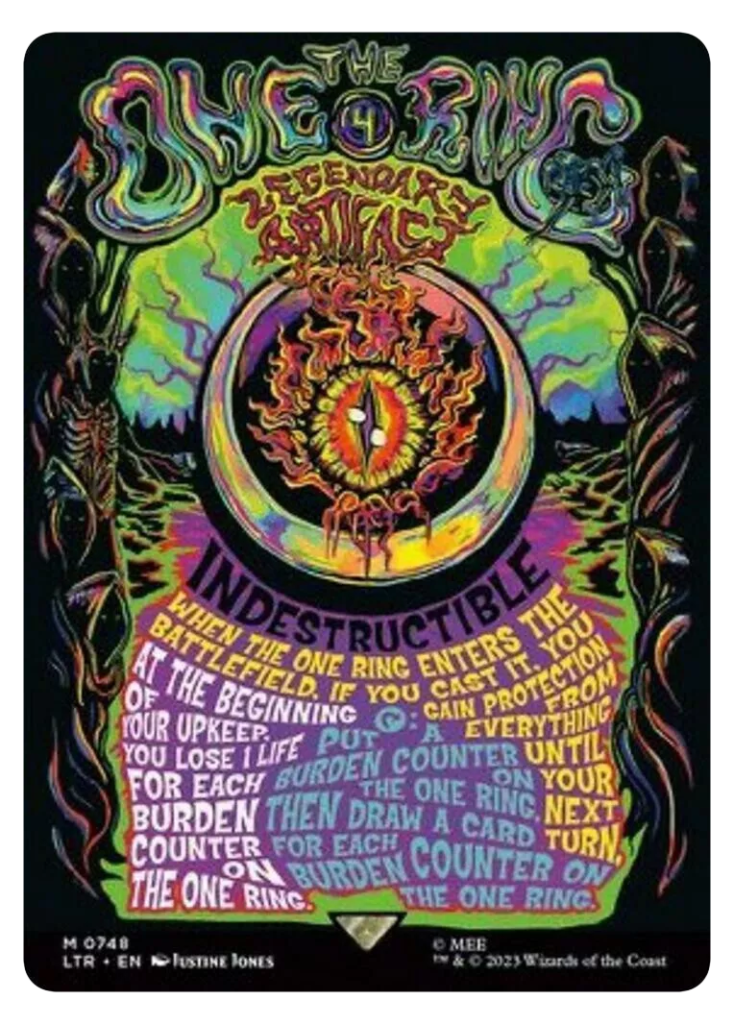

The One Ring “Borderless Poster” Magic: The Gathering Card

Magic: The Gathering’s crossover with Lord of the Rings made headlines last year when the 1 of 1 version of The One Ring card was sold for a staggering $2 million to noted MTG fan and famous music artist Post Malone. While you’ll probably never be able to afford that version of the card because of its one-of-a-kind rarity, it’s far more likely you can afford the second most rare version. This gnarly “Band Poster” variant of The One Ring by artist Justine Jones is quite eye-catching (see what we did there?). It’s certainly one of the most unique looking styles that has ever come to MTG, and if you look closely there are lots of little Easter eggs, such as the nine Nazgul along the border. The best part is that it’ll only set you back a couple hundred dollars instead of a couple million.

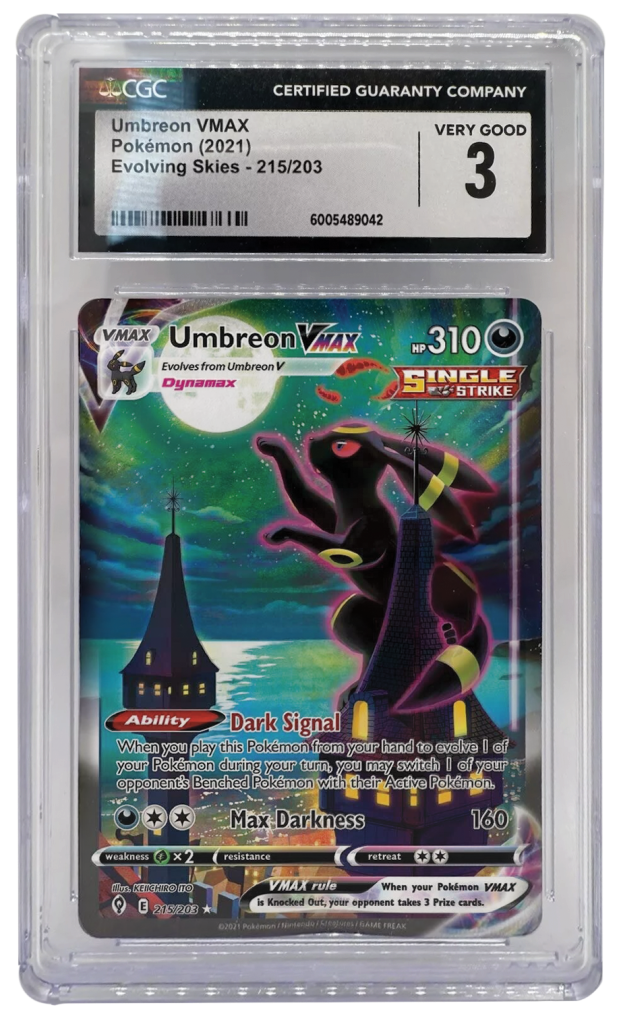

Umbreon VMAX Alternate Art Secret Rare Pokemon Card

It’s common knowledge that Pikachu, Charizard, and Mewtwo are the three most popular Pokemon, and cards featuring those characters tend to have a lot of value to collectors. But it might surprise you to hear that cards featuring a certain black-and-yellow Gen II Eeveelution are just as valuable. That’s right, we’re talking about Umbreon. The eye-catching Umbreon VMAX Alternate Art Secret Rare card from Evolving Skies, showing a giant version of the Pokemon reaching for the moon, is one of the most in-demand cards on the market, years after its release in 2021. Currently the card goes for about a grand(!) and the crazy part is that the value is still going up. If you’re looking to give someone an extremely generous Pokemon TCG gift, one ticket to the “Moonbreon” hype train looks like an investment that may pay off.

Buy the Umbreon VMAX Secret Rare Pokemon Card Here

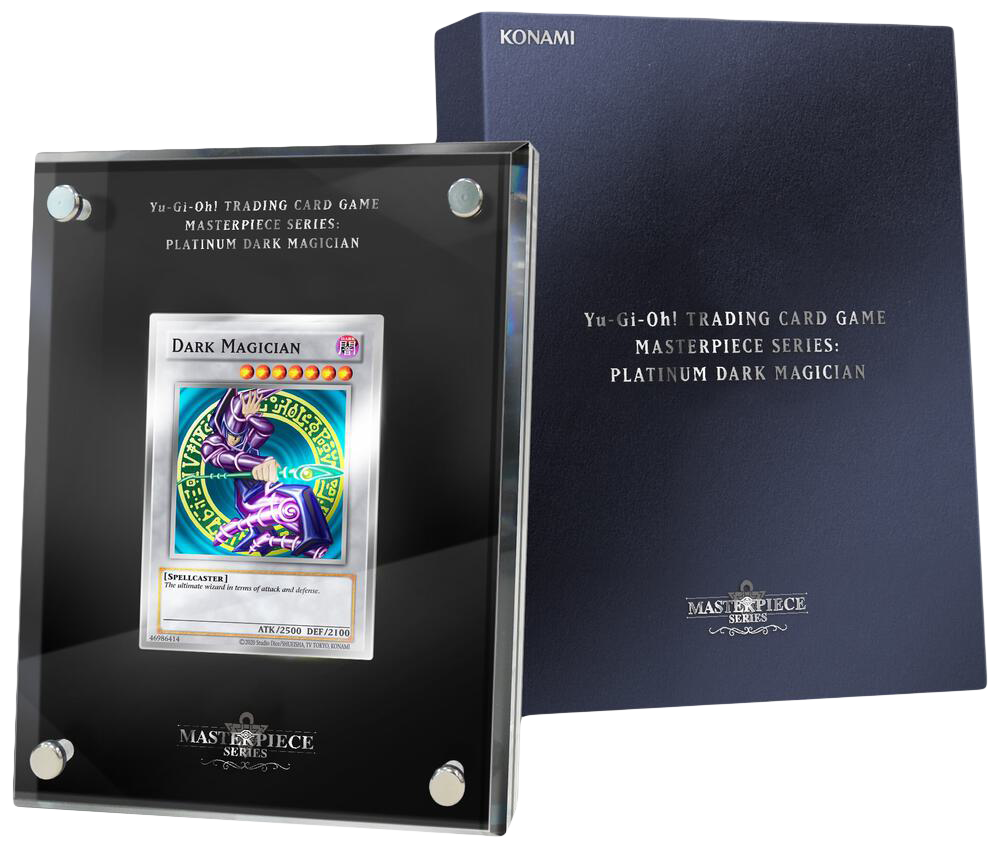

Masterpiece Series: Platinum Dark Magician Yu-Gi-Oh! Card

If you’ve ever wondered what the most expensive Dark Magician card looks like, then wonder no more. In 2023, Konami released the second card in their Masterpiece Series, the Platinum Dark Magician. Only 1000 of these were made and each bears a unique print number. The card is made of silver and comes in a handsome display case. As far as Yu-Gi-Oh! collectibles go, this is one of the most impressive there is. That is, unless you’re more of a Kaiba fan and would prefer to get the Platinum Blue-Eyes White Dragon card from 2021.

Buy the Platinum Dark Magician Yu-Gi-Oh! Card Here

“Pikachu with Grey Felt Hat” Pokemon x Van Gogh Card

You may have heard the news in 2023 about overeager Pokemon fans causing a riot trying to get their hands on a limited edition card at the Van Gogh Museum. Well, this is it. The “Pikachu with Grey Felt Hat” card features the Pokemon mascot wearing the same kind of headwear as depicted in Van Gogh’s classic painting, “Self-portrait with Grey Felt Hat.” The hype around this card certainly makes it one of the more unique Pokemon cards a collector can own. Even a year after its release, it remains one of the most in-demand Pokemon cards for collectors.